All nonprofit organizations, including 501(c)(3) tax-exempt organizations, in the United States are exempted from taxes. Even though these organizations are exempt from paying taxes, they have some responsibilities while operating and managing their own activities. They need to report their income & expense activities annually through Form 990.

If your nonprofit organization has appointed regular employees or contractors for day-to-day activities, you are also responsible for certain tax liabilities and reporting those liabilities to the respective federal & state agencies.

Tax Withholdings for your organization’s regular employees:

If you hire regular employees for your organization, you are responsible for withholding the following taxes from your employees' wages:

- Federal income tax withholding

- State & local income tax withholding

- FICA (Social Security and Medicare) taxes

In general, the nonprofit organization must deposit both the federal/state income tax withheld, in addition to the employer and employee portion of FICA taxes to the respective agencies.

FUTA Taxes:

- If your organization is exempt from income tax under section 501(c)(3) of the Internal Revenue Code, then you are not required to pay federal unemployment taxes (FUTA).

- If you organization is not described under the section 501(c)(3) organization, then you are responsible for paying taxes to Federal Unemployment Tax Act (FUTA).

Learn more about the FUTA taxes and its filing requirements by visiting https://www.taxbandits.com/form-94x-series/file-form-940-online/.

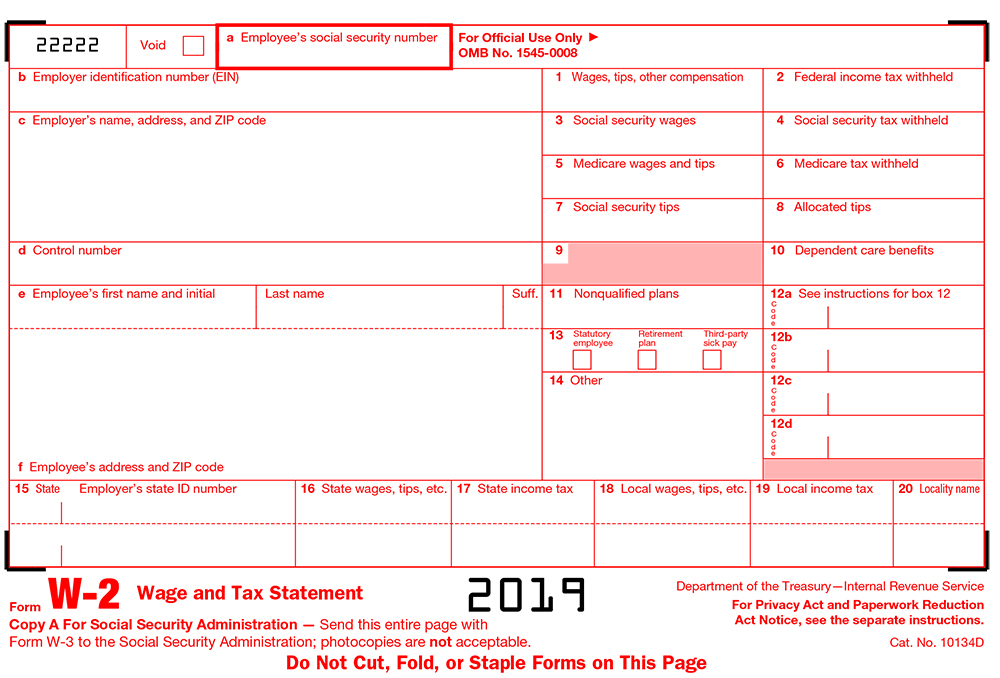

FORM W-2 - FILE YOUR EMPLOYEES’ WAGE & TAX STATEMENT

Nonprofit organizations need to report their employees' wages, & withholding information to the federal & respective state agencies through the W-2 Form.

The W2 Form consists of six copies:

Copy A - Submitted by the employer to the SSA.

Copy 1 - To be filed with the employer's state or local income tax returns.

Copy B - To be filed with the employee's federal income tax returns.

Copy C - To be sent to the employee, for the employee's records.

Copy D - To be retained by the employer, for the employer's records.

Copy 2 - To be filed with the employee's state or local income tax returns.

According to the IRS, all the nonprofit organizations must also issue the copies of W-2 forms to their employees each year so the employees can report their wages on their income tax return 1040.

Click here to know more about the Form W2 Boxes and Filing Instruction.

When is the due date to file W-2 Forms for tax year 2019

These deadline are not related to your nonprofit organization tax return deadline and need to be filed by these dates regardless of your accounting period.

Provide Copies to your employees

January 31, 2020

Paper Filing Deadline

January 31, 2020

E-Filing Deadline

January 31, 2020

Basic Information Required for Filing W-2 Forms

- Nonprofit organization’s details (Name, EIN, & Address).

- Employee details (Name, SSN, & Address).

- Federal wages & tax (Medicare & social security) information.

- State & local (wage & tax) information.

Filing W-2 Forms Electronically

Electronic filing is preferred by the IRS because it keeps everything running smoothly.

A quick & easy way for exempt organizations to file wage tax returns is through an IRS Authorized efile provider like “TaxBandits.com". Save your time by filling your W-2 returns electronically, and get an audit error-check for free when you file with TaxBandits.

HOW TAXBANDITS SIMPLIFIES FILING NONPROFIT W-2S FOR 2019?

TaxBandits provides nonprofit organizations the easiest way to e-file their W-2 forms directly with the SSA as well any required state. As an IRS-authorized e-file provider, TaxBandits help you e-file your W-2 form free of errors, and your Form W-3 will be generated automatically in TaxBandits’ system and available for your record. You can also correct your previously filed W-2 form with TaxBandits. E-filing Form W-2 with TaxBandits will save you time, and their expert support team is readily available to help you.

- TaxBandits can print & postal mail your employee copies of W-2s.

- TaxBandits also supports direct state filing of Form W-2 and state reconciliation forms.

- Import all your employee data in a single Excel template and upload it to TaxBandits’ system instantly to bulk file W-2 Forms Online.

- Access your forms anytime and anywhere through TaxBandit’s print center.

- Keep track your filing status with the IRS.

Learn More about how TaxBandits can help you file your W-2 Forms in a timely manner by visiting https://www.taxbandits.com/w2-forms/file-w2-form-online/.

TaxBandits also supports the following employment tax forms

Form 94x Series:

Form 941: Form 941 is a quarterly tax return of wages paid to your organization’s employees and taxes withheld (federal income tax withheld, social security and Medicare taxes withheld).

Form 944: Some small nonprofit organization (whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less) are required to file an annual Form 944 instead of quarterly return 941.

Form 940: If your nonprofit organization is not exempt from the unemployment taxes, then it must file Form 940 annually with the IRS.

Visit https://www.taxbandits.com/form-94x-series/ to know more about these Forms & our filing features.

Form 1099 Series:

Form 1099-MISC: If you paid any amount to contractors, or made any payments such as rent, medical and health care payments, crop insurance proceeds, payments made to attorney, etc., during the tax year, then you are required to file Form 1099-MISC with the IRS with the information stating the miscellaneous amount that you have paid and must send a copy to your recipient.

Form 1099-INT: Used to report if your organization (Credit Union, etc.,) paid any interest income (savings bond interest, checking and savings account interest, etc.,) to any individual, organization during the tax year.

TaxBandits also provides the e-filing solution to these 1099 Forms. Please visit https://www.taxbandits.com/form-1099-series/ to know more about these Forms & filing features.

Print & Postal Mailing

To make your e-filing experience even more convenient, you can choose to have TaxBandits print & postal mailing feature send copies of W2/1099 Forms to your recipients on your behalf.

State Filings

For the states that require it, you can quickly and easily e-file your state W2 forms or any reconciliation/transmittal forms you may need.

Correction Form

You can correct any errors found on a previously filed return by filing a correction form from your account.

User-Friendly E-Filing Service

Our interface offers intuitive, cloud-based service with easy directions for e-filing.

24*7 - Email Support

Contact our US-based customer support team 24/7 via email.