IRS Mandates Electronic Filing of 990 Returns for Tax-Exempt Organizations.

E-File Now

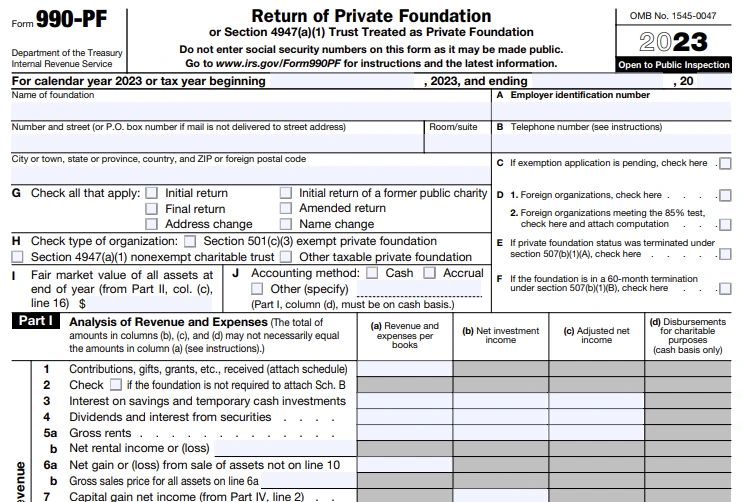

Form 990-PF Filing Requirements

- Basic Foundation details such as Name, EIN, Phone Number, Address

- Revenue details such as contributions, gifts, & grants, Interest received from investment

- Expenses details such as salaries, legal fees, accounting fees, travel costs, & more

- Assets details such as investments, land, buildings, and equipment

- Activities in Political, Unrelated business, Exchange properties, and more

- Officer details such as name, address, compensation, average working hours

- Direct Charitable Activities during the tax year and the Expenses

Visit https://www.expresstaxexempt.com/form-990-pf/form-990-pf-instructions/ to know more about the information required to file Form 990-PF.

How to File Form 990-PF Electronically?

To e-file Form 990-PF with Tax 990, follow the simple steps below:

Step 1

Step 2

Step 3

Step 4

Step 5

How to File Form 990-PF Electronically?

To e-file Form 990-PF with Tax 990, follow the below simple steps below:

Step 1

Step 2

Step 3

Step 4

Step 5

Why E-file Form 990-PF with Express990?

Express990 makes filing your Form 990-PF returns simpler by offering easy-to-use, streamlined e-filing features. Our Software supports tax filing for current (2023) and prior years (2022 & 2021). You can access the transmitted form copies anytime in our cloud database. We also have a dedicated support team to resolve your queries instantly.

Apart from this, we have many other helpful features to make your filing hassle-free.

Simple preparation process

Our direct form entry and interview-style questions with helpful instruction guide you through the filing process

quickly and easily.

Internal Audit Checks

If your Form 990-PF requires any Schedules or statements, Express990 can automatically generate those

based on your answers.

Copy Data From Prior Year Return

If your organization filed Form 990-PF with our software, you can copy certain information from your previously filed returns to use on future returns.

Amended Returns

Our software allows you to make corrections to your Form 990-PF previously filed with us or even with other

service providers.

Customer Testimonials

PRICING

- Includes Schedule-B for Free

- No Subscription Fee

- Pay only for the return you file

- Discounted Pricing for the Tax Professionals

- Live support via chat, mail, and phone.

Frequently Asked Questions on

Form 990-PF

Who needs to file Form 990-PF?

The organizations classified as exempt private foundations under section 501(c)(3) of the Internal Revenue Code, taxable private foundations, and section 4947(a)(1) nonexempt charitable trusts must annually file Form 990-PF.

When is the due date to file Form 990-PF?

Private foundations have until the 15th day of the 5th month after their tax year ends to file Form 990-PF with the IRS.

If your Organization follows the calendar tax year, then the deadline to file 990-PF is May 15.

What are Form 990-PF Schedules?

IRS Form 990-PF only requires Schedule B for additional information about any donations of money, securities, or other property worth at least $5,000. Express990 automatically generates a Schedule B based on your information from the form interview sections.

Click here to learn more about Form 990-PF Schedule B.

How do I get more time to file IRS Form 990-PF?

Private foundations that need more time to file Form 990-PF online can submit Extension Form 8868 for an automatic 6-month extension of time.

The organizations must file IRS Form 8868 by the original tax deadline, which is the 15th day of the 5th month after the tax year end date.

What Kind of Organizations is Exempt from Filing Form 990-PF?

Organizations that don't need to file IRS Form 990-PF are section 501(c)(3) tax-exempt groups that are classified as Public Charities. The IRS requires these public charities to submit Form 990, 990-EZ, or 990-N (Based on Their gross receipts and assets).

For example, churches, hospitals, schools, publically supported organizations, supporting organizations, and organizations that test for public safety do not need a 990-PF form.